第十八章 税务咨询和税务筹划与2008年旧教材相比,本章为新增章节。知识点1:税务咨询第一节 税务咨询一、税务咨询的概念(一)税务咨询的概念税务咨询是税务代理业务中最普遍性的服务内容。(二)税务咨询的形式(三)税务咨询的内容结合咨询内容和现实业务范围,税务咨询的内容主要包括以下几个方面:1、税收法律法规和政策规定方面的咨询2、税收法律法规和政策运用方面的咨询3、纳税操作规程方面的咨询4、涉税会计处理的咨询二、税务咨询的业务流程(一)税务咨询业务流程规则(二)税务咨询的业务流程三、税务咨询的技术要点和操作规范(一)税务咨询人员的素质要求(二)税务咨询的技术规则税务咨询的技术规则是咨询人员进行税务咨询所应遵守的专业活动技术准则。可以概括为12字原则,即:科学、合理、实用、效率、整体、超前。知识点2:税务筹划第二节 税务筹划一、税务筹划的概念(一)税务筹划的概念税务筹划指的是在税法规定的范围内,通过对经营、投资、理财等活动的事先筹划和安排,尽可能地获得“节税”的税收利益。它是税务代理机构可从事的不具有鉴证性能的业务内容之(三)税务筹划相关概念1、节税(tax saving)。顾名思义,就是节减税收。

是纳税人利用税法的政策导向性,采取合法手段减少应纳税款的行为,一般是指在多种营利的经济活动方式中选择税负最轻或税收优惠最多的而为之,以达到减少税收的目的。节税具有合法性、政策导向性、策划性、倡导性的特征。2、避税(tax avoidance)。避税是纳税人利用税法的漏洞、特例或者其他不足之处,采取非违法的手段减少应纳税款的行为。避税具有非违法性、策划性、权利性、规范性和非倡导性的特点。3、逃税与偷税。逃税(tax evasion)是纳税人故意违反税收法律法规,采取欺骗、隐瞒等方式,逃避纳税的行为。偷税(tax fraud)二、税务筹划基本方法基本方法具体方法(一)税务筹划的切入点五大切入点:1.选择税务筹划空间大的税种为切入点2.以税收优惠政策为切入点3.以纳税人构成为切入点4.以影响应纳税额的几个基本因素为切入点5.以不同的财务管理环节和阶段为切入点(二)利用优惠政策筹划法从总体角度来看,利用优惠政策筹划的方法主要包括:1.直接利用筹划法。2.地点流动筹划法。3.创造条件筹划法。从税制构成要素的角度探讨,1.利用免税2.利用减税3.利用税率差异4.利用分劈技术5.利用税收扣除6.利用税收抵免7.利用延期纳税8.利用退税(三)利用转让定价筹划法企业之间转移收入或利润时定价的主要方式有:1.以内部成本为基础进行价格转让。

2.以市场价格为基础进行价格转让关联企业之间进行转让定价的方式有很多,一般来说主要有:1.利用商品交易进行筹划。2.利用原材料及零部件购销进行筹划。3.利用关联企业之间相互提供劳务进行筹划。4.利用无形资产价值评定困难进行筹划。(四)利用税法漏洞筹划法1.利用税法中的矛盾进行筹划。2.利用税务机构设置不科学进行筹划。3.利用税收管辖权进行筹划。(五)利用会计处理方法筹划法1.存货计价方法的选择2.固定资产折旧的税务筹划:包括固定资产计价、折旧年限、折旧方法、计价和折旧的税务筹划方法的综合运用【例题·多选题】从总体角度来看,利用优惠政策筹划的方法主要包括()。A.直接利用筹划法B.分劈技术筹划法C.创造条件筹划法D.利用退税筹划法【答案】AC【解析】从总体角度来看,利用优惠政策筹划的方法主要包括:直接利用筹划法、地点流动筹划法、创造条件筹划法。【例题·计算题——《梦想成真-经典题解》跨章节练习 第12题】 本题涉及土地增值税法、营业税法、城建税法(教育费附加)、税收筹划。某房地产开发公司专门从事普通住宅商品房开发。2008年3月2日,该公司出售普通住宅一幢,总面积91000平方米。该房屋支付土地出让金2000万元,房地产开发成本8800万元,利息支出为1000万元,其中40万元为银行罚息(不能按收入项目准确分摊)。

假设城建税税率为7%咨询公司税务筹划,印花税税率为0.05%、教育费附加征收率为3%。当地省级人民政府规定允许扣除的其他房地产开发费用的扣除比例为10%。企业营销部门在制定售房方案时,拟定了两个方案,方案一:销售价格为平均售价2000元/平方米;方案二:销售价格为平均售价1978元/平方米。要求:根据上述资料,按下列序号计算回答问题,每问需计算出合计数:(1)分别计算各方案该公司应纳土地增值税;(2)比较分析哪个方案对房地产公司更为有利,并计算两个方案实现的所得税前利润差额。【答案】(1)各方案该公司应纳土地增值税方案一:计算扣除项目:①取得土地使用权所支付的金额:2000万元②房地产开发成本:8800万元③房地产开发费用=(2000+8800)×10%=1080(万元)④税金:销售收入=91000×2000÷10000=18200(万元)营业税=18200×5%=910(万元)城建税及教育费附加=910×(7%+3%)=91(万元)印花税=18200×0.05%=9.1(万元)土地增值税中可以扣除的税金=910+91=1001(万元)⑤加计扣除=(2000+8800)×20%=2160(万元)扣除项目金额合计=2000+8800+1080+1001+2160=15041(万元)增值额=18200-15041=3159(万元)增值率=3159÷15041=21%<50%,适用税率30%。

土地增值税税额=3159×30%=947.7(万元)方案二:计算扣除项目: ①取得土地使用权所支付的金额:2000万元②房地产开发成本:8800万元③房地产开发费用=(2000+8800)×10%=1080(万元)④与转让房地产有关的税金:销售收入=91000×1978÷10000=17999.8(万元)营业税=17999.8×5%=899.99(万元)城建税及教育费附加=899.99×(7%+3%)=90(万元)印花税=17999.8×0.05%=9(万元)土地增值税中可以扣除的税金=899.99+90=989.99(万元)⑤加计扣除=(2000+8800)×20%=2160(万元)扣除项目金额合计=2000+8800+1080+989.99+2160=15029.99(万元)增值额=17999.8-15029.99=2969.81(万元)增值率=2969.81÷15029.99=19.76%根据土地增值税税收优惠规定:建造普通标准住宅出售,增值额未超过扣除项目金额20%的,免征土地增值税,所以,第二种方案不交土地增值税。(2)比较分析对房地产公司更为有利的方案,并计算两个方案实现的所得税前利润差额。

①方案一所得税前利润=18200-(2000+8800+1000+1001+9.1+947.7)=4442.2(万元)方案二所得税前利润=17999.8-(2000+8800+1000+989.99+9)=5200.81(万元)方案二虽然降低了售价,但是由于不需要缴纳土地增值税,使得税前利润较方案一高,所以咨询公司税务筹划,对房地产公司更为有利的是方案二。②两种方案在所得税前利润差额=5200.81-4442.2=758.61(万元)第三节税务咨询和税务筹划的风险控制税务咨询和税务筹划的执业风险指税务代理人员因未能完成代理事项和履行代理职责所要承担的法律责任。其产生风险的原因主要源自委托人即纳税人、扣缴义务人和代理人员及其机构自身。风险产生因素内容(一)从委托人方面产生的风险因素1.委托人的纳税意识。2.委托人的委托意向与合作态度。3.委托人的财务核算基础。(二)执业人员及其机构方面产生的风险因素1.执业人员的职业道德水平。2.执业人员的专业胜任能力。3.受托代理机构执业质量控制程度。manufacturers of technical documents on the quality requirements applicable to this project. Construction quality inspection and evaluation standards issued by the national power company of the electric power construction standard for quality inspection and assessment of the 11 articles assessment inspection standards as well as other relevant regulations issued by the Ministry of electric power, the State power company executive. Does not verify in the specification within the evaluation criteria, implementation design, manufacturer or ... Or issue a new national standards and regulations, bidders shall comply with new norms and standards. If there are conflicts or is inconsistent, whichever is the higher standards. 3.3 3.3.1 project of responsibility, authority and communication organization and project managers, at all levels of responsibility and authority see section II of chapter III of the present tender site management organization and part of workforce planning. 3.3.2 according ISO 9001, GB/T 50430 and company quality distribution of the quality manual, combining the departments of projects, project quality function distribution allocation table on the following page of the project's quality functions shown below. 3.3.3 project with each Department interface, interface between the internal departments of the project by project managers at all levels and the quality regulations of the responsibilities and authorities of the Department. Customer requirements and hope: project management; Quality planning, management program: the project's quality control Department; Site design: Project Engineering Department; Contract: the contract budgetmanufacturers of technical documents on the quality requirements applicable to this project. Construction quality inspection and evaluation standards issued by the national power company of the electric power construction standard for quality inspection and assessment of the 11 articles assessment inspection standards as well as other relevant regulations issued by the Ministry of electric power, the State power company executive. Does not verify in the specification within the evaluation criteria, implementation design, manufacturer or ... Or issue a new national standards and regulations, bidders shall comply with new norms and standards. If there are conflicts or is inconsistent, whichever is the higher standards. 3.3 3.3.1 project of responsibility, authority and communication organization and project managers, at all levels of responsibility and authority see section II of chapter III of the present tender site management organization and part of workforce planning. 3.3.2 according ISO 9001, GB/T 50430 and company quality distribution of the quality manual, combining the departments of projects, project quality function distribution allocation table on the following page of the project's quality functions shown below. 3.3.3 project with each Department interface, interface between the internal departments of the project by project managers at all levels and the quality regulations of the responsibilities and authorities of the Department. Customer requirements and hope: project management; Quality planning, management program: the project's quality control Department; Site design: Project Engineering Department; Contract: the contract budgetmanufacturers of technical documents on the quality requirements applicable to this project. Construction quality inspection and evaluation standards issued by the national power company of the electric power construction standard for quality inspection and assessment of the 11 articles assessment inspection standards as well as other relevant regulations issued by the Ministry of electric power, the State power company executive. Does not verify in the specification within the evaluation criteria, implementation design, manufacturer or ... Or issue a new national standards and regulations, bidders shall comply with new norms and standards. If there are conflicts or is inconsistent, whichever is the higher standards. 3.3 3.3.1 project of responsibility, authority and communication organization and project managers, at all levels of responsibility and authority see section II of chapter III of the present tender site management organization and part of workforce planning. 3.3.2 according ISO 9001, GB/T 50430 and company quality distribution of the quality manual, combining the departments of projects, project quality function distribution allocation table on the following page of the project's quality functions shown below. 3.3.3 project with each Department interface, interface between the internal departments of the project by project managers at all levels and the quality regulations of the responsibilities and authorities of the Department. Customer requirements and hope: project management; Quality planning, management program: the project's quality control Department; Site design: Project Engineering Department; Contract: the contract budget

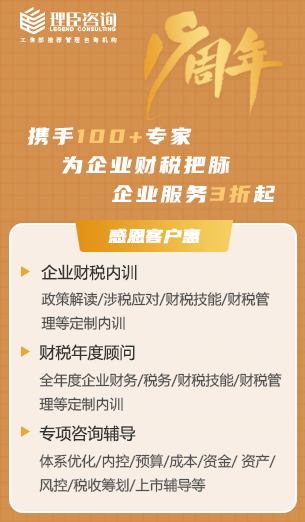

更多财税咨询、上市辅导、财务培训请关注理臣咨询官网 素材来源:部分文字/图片来自互联网,无法核实真实出处。由理臣咨询整理发布,如有侵权请联系删除处理。

400-835-0088

400-835-0088